Bookkeeping, tax, & tax credits for startups.

Fondo is the easy way for startups to get their bookkeeping done, taxes filed, and cash back from the IRS (average startup gets $21k). We’ll optimize and file your taxes, and you’ll get cash back — up to $500k per year. Need more help? We’ll also do your bookkeeping, so you don’t have to worry about a thing.

Latest News

Active Founders

David J. Phillips

CEO of Fondo - the easy way for startups to get their books closed, taxes filed, and cash back from the IRS ($21k on average). Angel investor in 50+ startups including Rippling, Flexport, & Career Karma. Started my career as an accountant at Deloitte, then learned to code & started my founder journey. I co-founded Hackbright where we’ve trained 1,000+ software engineers and were acquired by Capella University (NASDAQ: $CPLA). Before that, I co-founded safeXai (backed by $223M in vc).

Company Launches

👋 Hi everyone,

David here, former accountant & CEO/Founder of Fondo (W18). Last week, President Biden signed the Inflation Reduction Act into law -- which includes doubling the R&D Credit available per startup to up to $500k per year. This is great news for startups and we’d love to help you get the maximum money back from the IRS.

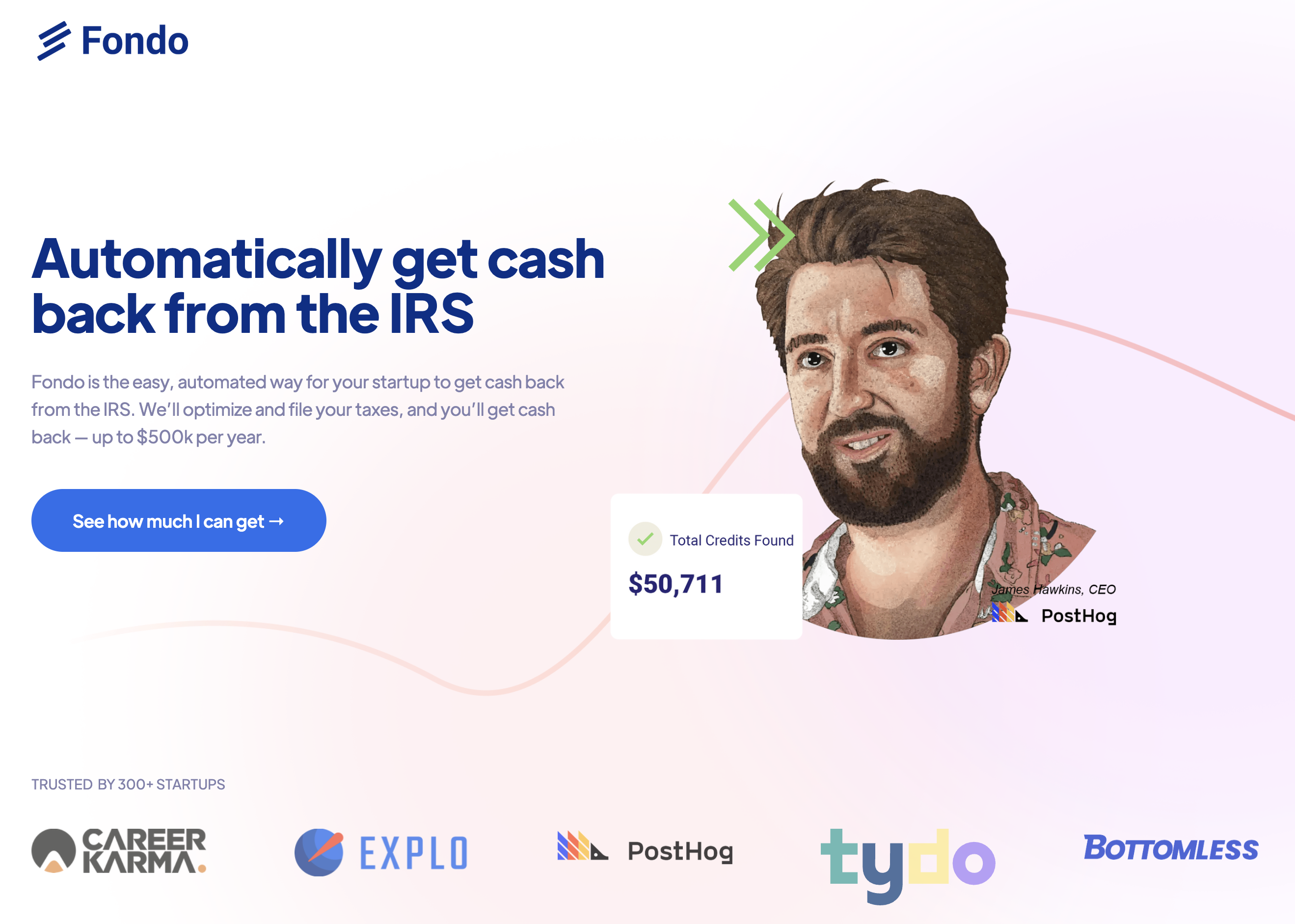

💰 Automatically get cash back from the IRS (average startup gets $21,000)

Today, we are publicly launching Fondo Tax Credits to help startups get cash back from the IRS.

Thank you to @Career Karma, @Explo, @PostHog, @Tydo, & @Bottomless being our first 5 Tax Credit customers.

Does my startup qualify?

Most likely, yes! Startups with less than $5M in gross receipts will generally qualify. Because of the broad definition for qualified activities, startups from almost every industry have claimed R&D tax credits. If you have employees or contractors in the United States who spend any time developing new or improved products, processes, software, algorithms, formulas, or inventions, then you likely qualify for the R&D tax credit. See if your startup qualifies →

How much does my startup qualify for?

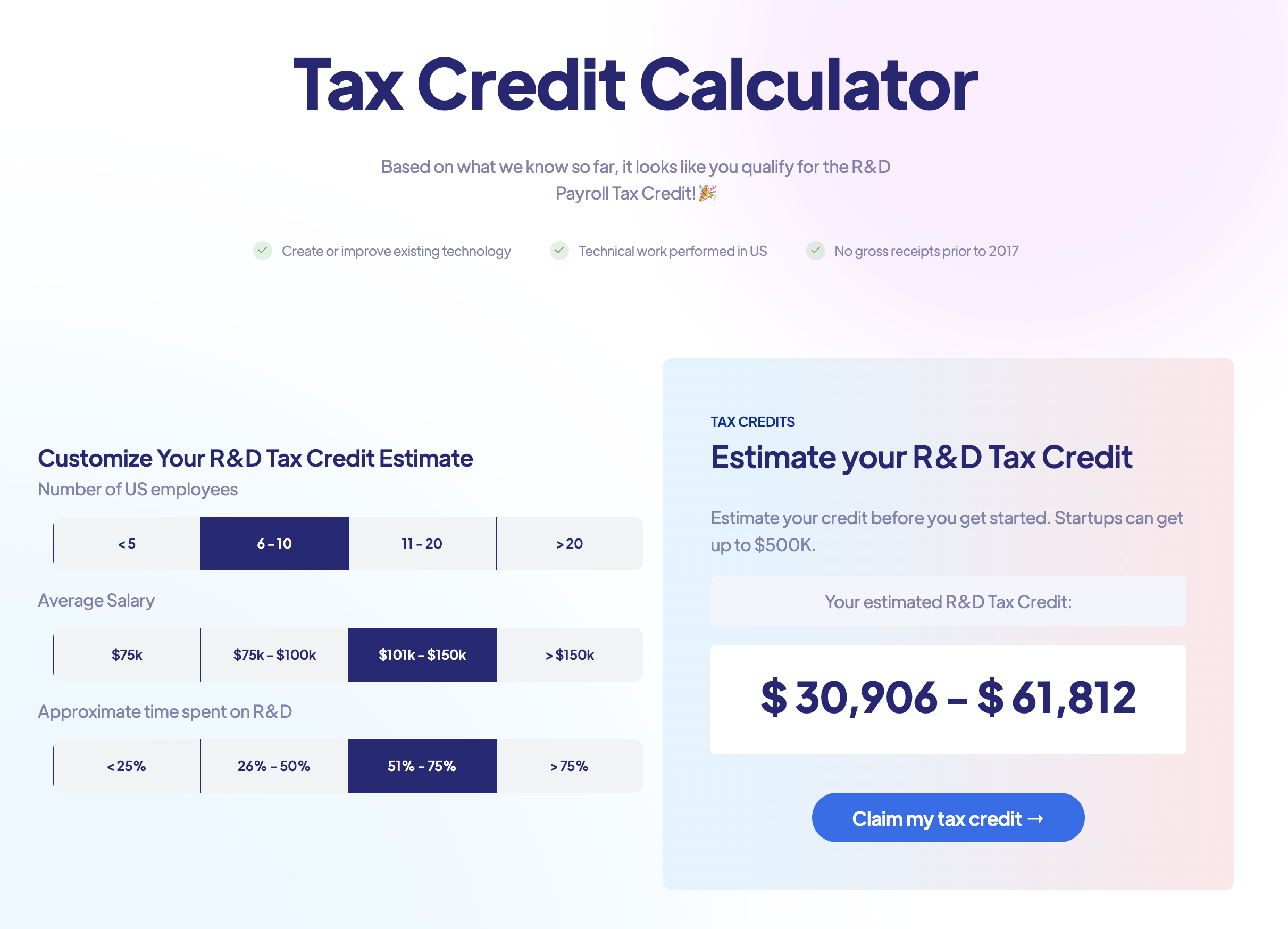

The amount of money you can get back is based on your company's R&D expenses (founder/employee/contractor payroll) and can be up to $500k per year. See how much you can get back with our Tax Credit Calculator →

How do I claim the credit?

Fondo handles all of this for you — the credit is claimed by doing an R&D Credit study, filing additional forms with your corporate tax returns, and updating your payroll system. Get started here →

⚠️ Upcoming Deadline

The deadline to claim this credit for 2021 is 10/17/22 (if you filed an extension), otherwise you can claim the credit for 2022.

🤝 DEAL: 25% OFF Tax Credits

Sign up by 8/25/22 to use this deal. You only pay Fondo if we can help you get money back. Typically, our fees will not exceed 20% of the amount we can help you get back. This deal will cap the amount you pay Fondo at 15%.

What do you get?

The benefits of claiming your tax credits with Fondo is that we can handle everything you need to get it done -- end-to-end. Most of our competitors will only do the R&D study and you still need to find someone else to (1) file your tax returns with the attached R&D credit forms, (2) update your payroll system, and (3) do your bookkeeping.

- ✅ Cash back from the IRS (Fondo will complete the R&D Credit Study, prepare Tax Forms, and make required updates to your payroll system)

- ☑️ Optional Add-on: TaxPass - Delaware + Federal/State Corporate Income Taxes Filed (timely filings that you need to claim the credit)

- ☑️ Optional Add-on: Bookkeeping (get financial statements that you need to file your tax returns)

We’d love to support you!

Thank you!

David